THE MONTHLY 'RAP'

Trump and Tariffs, and 158 Carats: The Diamond Industry Reacts

During the initial period after US President Donald Trump’s announcement that he would hike tariffs on all countries, Petra Diamonds postponed its Cullinan tender, while Signet informed suppliers it would accept only pre-tariff agreed-upon pricing. The Israel Diamond Exchange (IDE) withdrew from the World Federation of Diamond Bourses (WFDB) amid ongoing disputes over tariffs and other issues, and the Gemological Institute of American (GIA) announced it would no longer accept overseas items requiring shipment to the US, instead expanding its international lab services. Meanwhile, the European Union confirmed it would not impose tariffs on US diamond imports, offering some relief to transatlantic trade. All that before Trump paused reciprocal levies for a 90-day period to negotiate with other countries, while at the same time jacking up tax on China to 145%.

The month also proved a mixed bag for diamonds. India’s polished-diamond exports fell to a two-decade low, and Luk Fook indicated a retreat from diamond retail. Still, there were signs of resilience — De Beers committed to decade-high spending on natural-diamond marketing, the Lulo mine reported an increase in rough reserves and a survey showed average engagement ring spend in the US growing. Auction houses also drew global attention with colored diamonds as Christie’s listed its Golconda Blue with a $50 million price tag — and later withdrew the piece from sale — while Sotheby’s is offering a 10-carat blue diamond dealers expect to fetch up to $30 million. Big yellows also made headlines, including a 53-carat, fancy-vivid-yellow at Phillips Geneva and Rio Tinto’s discovery of a 158-carat rough in Canada.

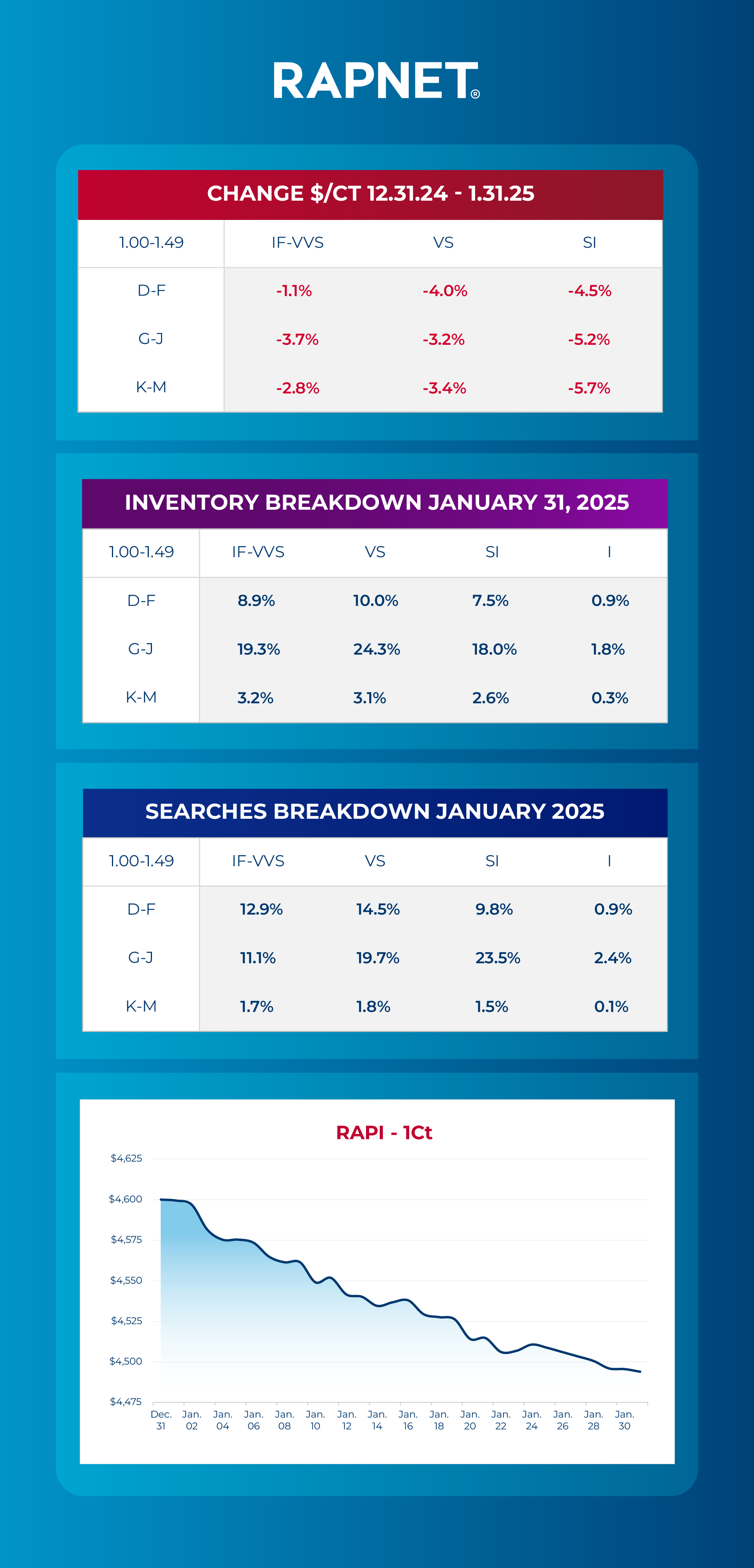

Here's your diamond market analysis from RapNet for April 2025

In April, diamond prices initially rose following the tariff announcement but later stabilized after a ninety-day postponement was declared. Prices for goods within the United States remained relatively high, partially reflecting the anticipated tariff costs.

<<Click here>> to join the industry's largest and most trusted

diamond, gem and jewelry trading network.

Back to Newsletters

Back to Newsletters

![Diamonds 6[1][1]](/media/2120/diamonds-6-1-1.png)