THE MONTHLY 'RAP'

Las Vegas Highs and Lows, Marketing Woes and a Deluge of De Beers

The Las Vegas shows set the tone for June, signaling a cautious but resilient market. While higher-end jewelers at Luxury and JCK reported positive sales and steady traffic, overall sentiment among diamond dealers remained mixed. On the branding front, natural-diamond marketing continued to spark debate. Producers gathered in Angola to establish a collective marketing fund, aiming to strengthen messaging around natural diamonds. Industry reactions ranged from enthusiasm to skepticism, with some questioning whether recent campaigns had gone too far, potentially “jumping the shark.” The Antwerp World Diamond Centre (AWDC) stirred controversy with its lab-grown diamond gumball machine stunt, while a Belgian lab announced it would stop certifying loose synthetics. Moreover, a Rapaport survey found that the trade and consumers overwhelmingly thought the new natural-diamond marketing was too negative on synthetics.

Meanwhile, De Beers unveiled its “beacon” jewelry line and new traceability initiatives amid major structural shifts dominating headlines for the miner. Botswana confirmed that Debswana — its 50-50 joint venture with De Beers — paused production at some mines in the face of sluggish demand and was exploring capital markets to fund the $6 billion Jwaneng underground expansion. Meanwhile, ex-CEOs Gareth Penny and Bruce Cleaver, among other parties, have reportedly submitted separate bids to acquire De Beers from Anglo American.

Company results showed signs of continued market strain. Petra’s rough prices slipped at its recent tender due to a weaker product mix. Chow Tai Fook saw revenue dip as strong gold prices pulled shoppers away from diamond jewelry. Hong Kong jeweler Tse Sui Luen (TSL) still expects a full-year loss, albeit smaller than anticipated. In contrast, Signet posted a sales increase, largely owing to strategic changes under its new leadership.

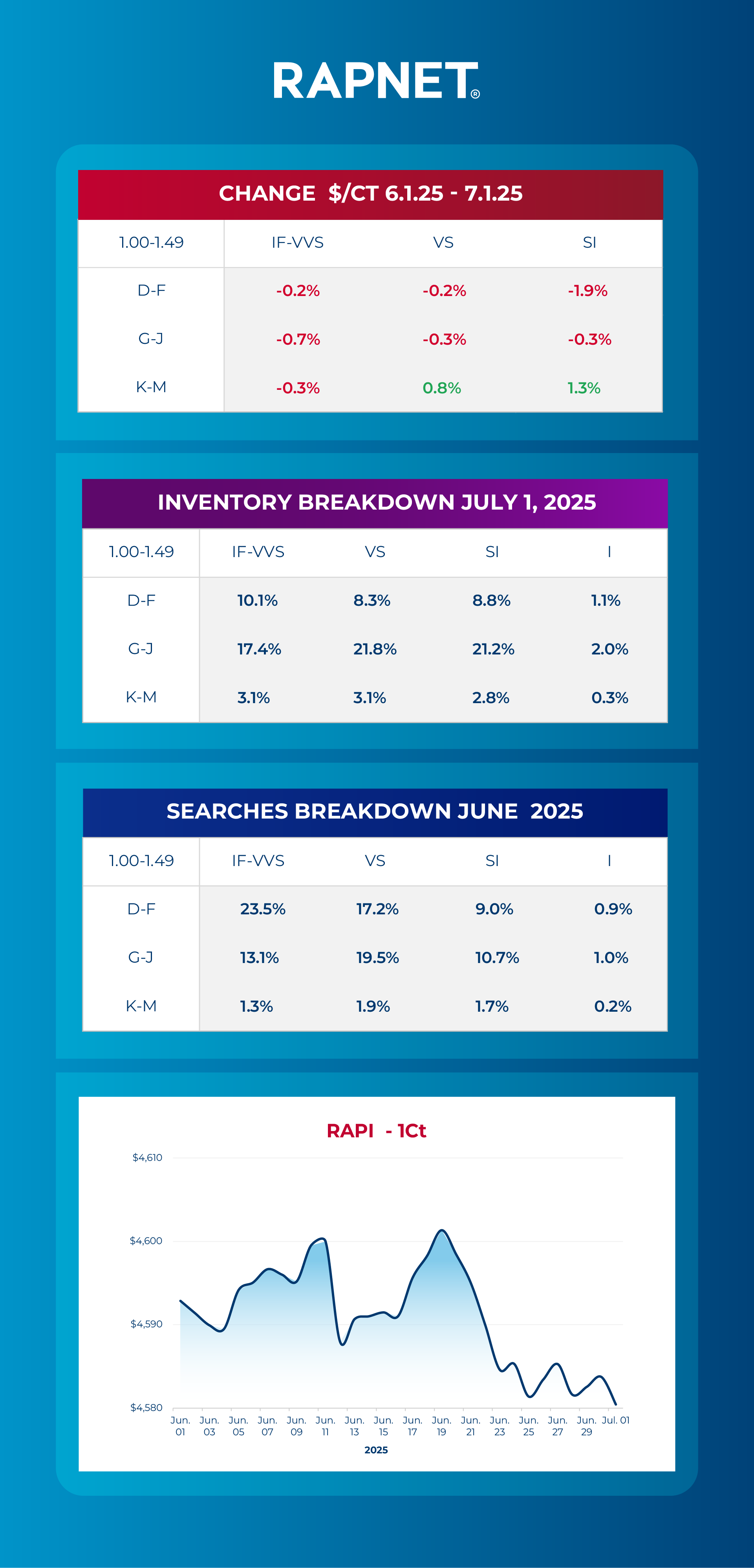

Here's your diamond market analysis from RapNet for June 2025

In June, the diamond market remained cautious, with the 1ct RAPI reaching $4,580 by month’s end. While D–F SI diamonds dropped by 1.9%, lower-quality K–M SI goods rose 1.3% in the last week of the month, and G–J categories saw modest declines. Inventory increased in D–F IF–VVS and in G-J VVS and declined in D-F VS and G-J VS but still remained heavily concentrated in G–J VS and SI stones. Buyer interest shifted toward premium D–F IF–VVS diamonds, which jumped to 23.5% of searches—up from 19.3% in May.

<<Click here>> to join the industry's largest and most trusted

diamond, gem and jewelry trading network.

Back to Newsletters

Back to Newsletters

![Diamonds 6[1][1]](/media/2120/diamonds-6-1-1.png)