THE MONTHLY 'RAP'

The Good, the Bad and the Lab-Grown

This month presented a mixed bag for the industry. Many companies reported lackluster results, with Canadian jeweler Birks seeing its full-year loss deepen and LVMH’s jewelry and watch sales down in the first half. De Beers expects a loss for the first half following stock rebalancing, while weak demand in Asia Pacific hurt Hong Kong luxury sales, Chow Tai Fook revenue and TSL’s bottom line. Meanwhile, some mass layoffs hit the mining sector. Gem Diamonds cut 20% of its workforce at the Letšeng mine, and Burgundy let go of “several hundred employees. The owner of the Mothae mine in Lesotho dismissed 400 workers.

Despite the chaos, Swatch Group saw demand begin to pick up in China, and Luk Fook increased its diamond offering amid improved sales. Richemont’s revenue grew thanks to a lift in the US market, and Indian jeweler Titan reported a rise in sales even as gold prices remained high. Watches of Switzerland posted record revenue, as did Prime day, raking in $24B.

The lab-grown versus natural war continued to rage, as IGI reiterated its intention to continue grading synthetics using the 4Cs — in response to the GIA’s announcement it would migrate its terminology away from the 4Cs and HRD’s statement it would cease grading loose lab-grown. Experts tried to determine whether the changes would have any effect on the lab-grown industry, and France stood by its decision to require the use of the word “synthetics” in reference to man-made stones.

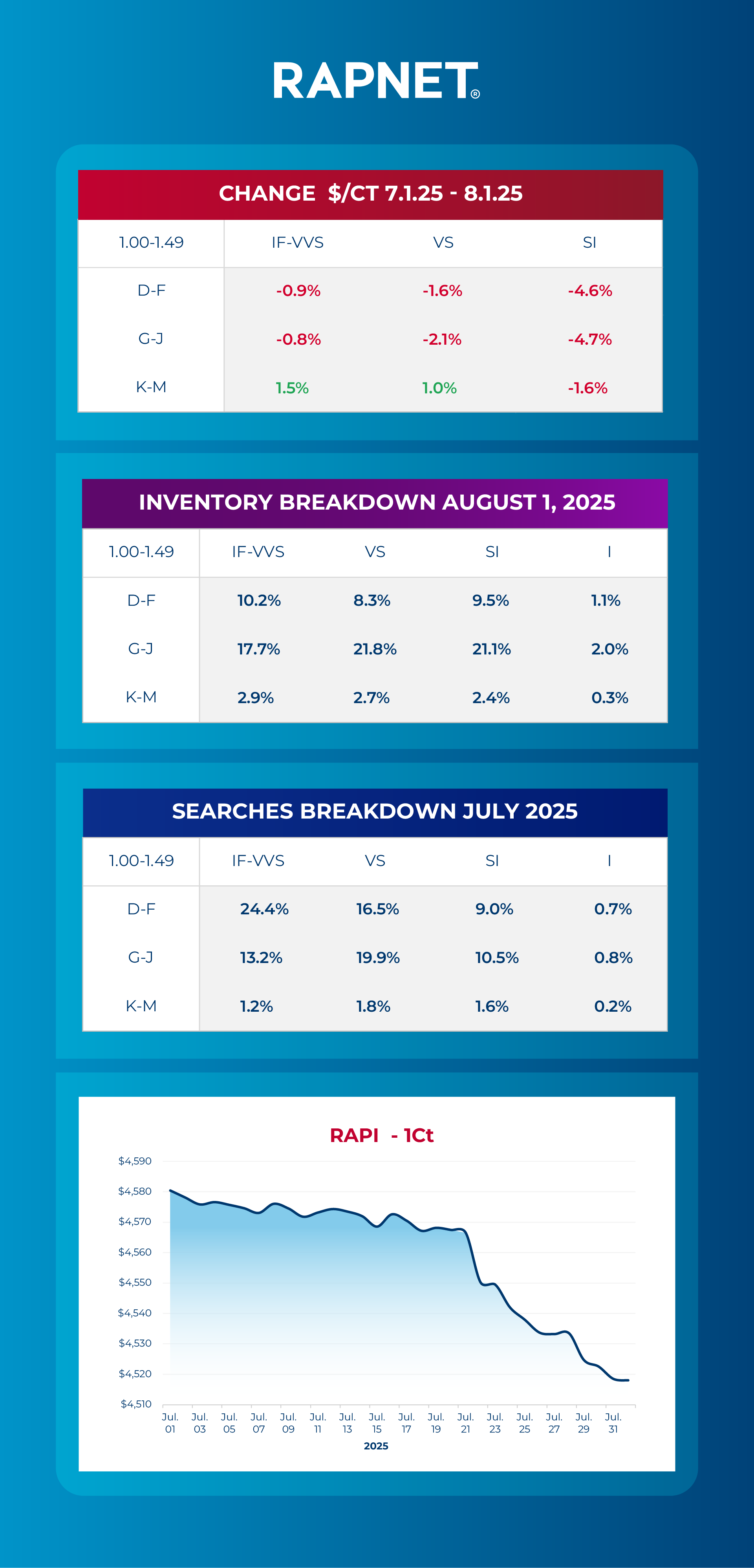

Here's your diamond market analysis from RapNet for July 2025

In July, the 1 CT RAPI fell 1.4% to $4,518, after staying mostly stable in June. Mid-tier D-H VS led the decline, down 1.9%, while higher-clarity IF-VVS dropped 0.8%. D-F and G-J SI categories fell sharply by 4.6%, compared to a 1.1% drop in June. In contrast, K-M VS-SI rose 1.1%. Inventory levels and searches on RapNet remained unchanged for the third straight month. Price and inventory shifts were seen in the US at month-end due to the new 25% tariff on Indian diamonds, but these are not yet reflected in the data.

<<Click here>> to join the industry's largest and most trusted

diamond, gem and jewelry trading network.

Back to Newsletters

Back to Newsletters

![Diamonds 6[1][1]](/media/2120/diamonds-6-1-1.png)